Editors Note: Mike Lingle is the Managing Director of 10xU, the startup school born from Rokk3r Labs’ experience cobuilding 40+ companies. 10xU’s goal is to give entrepreneurs the mindset and roadmap they need to successfully create high-growth businesses—which also creates more opportunities for investors.

We just held our first 10xU pitch day on August 1, where we put five startups in front of multiple investors including the $150 million Rokk3r Fuel fund.

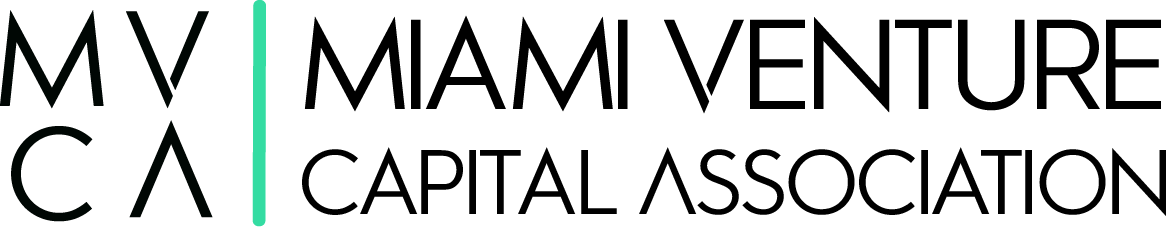

We’d spent the previous weeks workshopping the pitches and realized we needed an objective way to help founders identify strengths they should focus on, quickly add any missing info that investors would want to see, and uncover areas for improvement to focus on in the coming months (usually related to validation).

So we created a Pitch Deck Roadmap tool in order for us to actually measure the improvement the founders made.

Pitch deck mapping is also great for sharing information between investors, which is why I want to share it with you.

A Useful Tool for Investors

Here’s how you can use the 10xU Pitch Deck Roadmap in your investing:

- Quickly filter through pitch decks

- Determine which deals interest you

- Share comments with other investors—and possibly entrepreneurs

Here’s what the summary page looks like after using the tool to map a pitch deck:

The goal isn’t to get 100% in every category—in fact, we haven’t seen a pitch deck yet that comes close. Rather, it’s a way for investors to take the emotion out of reviewing pitch decks, and also a way for entrepreneurs to get the detailed feedback they’re looking for on how to improve their pitch.

We want to help both parties take some of the risk out of company-building. As I mentioned earlier, I expect this tool to evolve to better help investors make it a useful due diligence tool. Evaluating companies can be difficult and cumbersome, and we’re always looking for ways to add more method to the madness. Most importantly, you want to have a consistent and repeatable process to ensure analytical rigor. Lots of industries use standardized checklists as do many top VC’s.

We chose our evaluation criteria based on data from CB Insights about why companies fail—and mapped it to six pillars of startup success:

- Vision—Solves for bad business model and getting out-competed.

- Product—Solves for no product / market fit.

- Execution—Solves for not the right team.

- Growth—Solves for poor growth strategy.

- Technology—Solves for poor product issues.

- Investment—Solves for run out of cash and costs issues.

We’ve built these six pillars into the Pitch Deck Roadmap Tool, and also into our six-week Cobuild Course to teach entrepreneurs to build exponential startups on limited resources.

Does this line up with the way you typically evaluate startups?

Making Improvements

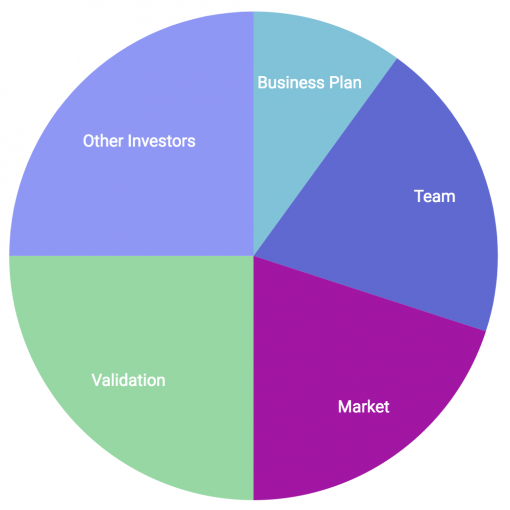

We know, of course, that risk is never evenly distributed across the board. We also know that investors make decisions based on other factors besides the business plan.

One aspect that the Pitch Deck Roadmap Tool does not take into account yet is helping investors weight their selection criteria based on their investment thesis or experience. Depending on the individual, they might value (or weight) the team higher than their business plan, for example. Weighting may also change depending on what stage the company is in.

How an investor might weigh their investment criteria.

We’d like to make our Pitch Deck Roadmap as useful as possible for investors, and we plan on including weighting in our next version. Our goal is to help you identify the great deals so that you can invest in them, while speeding up your ability to filter everything that comes across your desk. This also provides a way for MVCA members to share information with each other.

You can grab the 10xU Pitch Deck Roadmap tool here:

You can also find a video tutorial by clicking here.

And please let me know how it goes and what you’d like to see improved. In my next post I will be reviewing a real deck and will mention the feedback I received.

For more practical suggestions for entrepreneurs, visit 10xU.com or connect with me on LinkedIn.